What Is Leave Loading? Your 101 Guide To Leave Loading Types

Considering the reported $509 million in unpaid wages and entitlements for 251,475 workers in Australia, wage theft is no small matter. Ignoring leave loading is one way you could fall short.

Leave loading (or holiday loading) is extra pay employees receive while on annual leave. It helps cover lost overtime, penalty rates, or extra costs incurred during leave. Employers must check eligibility under the National Employment Standards, contracts, or awards and calculate it correctly, as mistakes can lead to fines, back payments, and damage to reputation.

This article discusses how leave loading works, the different types of leave loading, and how to calculate it.

Contents

What is leave loading?

HR’s role in leave loading

Payroll’s role in leave loading

How to calculate leave loading

How to determine leave loading entitlements

Annual leave loading vs. holiday leave loading

Does leave loading apply on termination?

Superannuation on leave loading

FAQ

What is leave loading?

Leave loading is an additional payment for employees on annual leave. It is typically calculated as a percentage of the base wage, usually 17.5%, though some awards may specify a different rate. Its goal is to make up for the income lost from overtime or penalty rates. Not every employee is eligible, as it depends on the specific employment agreement.

The implications of leave loading for HR and payroll teams include key considerations impacting employee entitlements, payroll calculations, compliance, and overall business costs.

Businesses must adhere to the Fair Work Act and relevant industrial agreements. Incorrect applications can breach workplace laws, lead to audits, or result in penalties from the Fair Work Ombudsman (FWO).

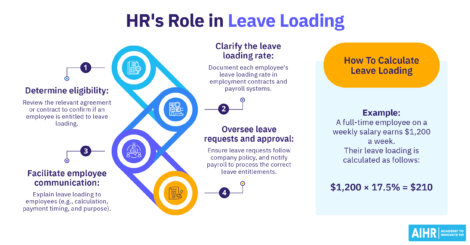

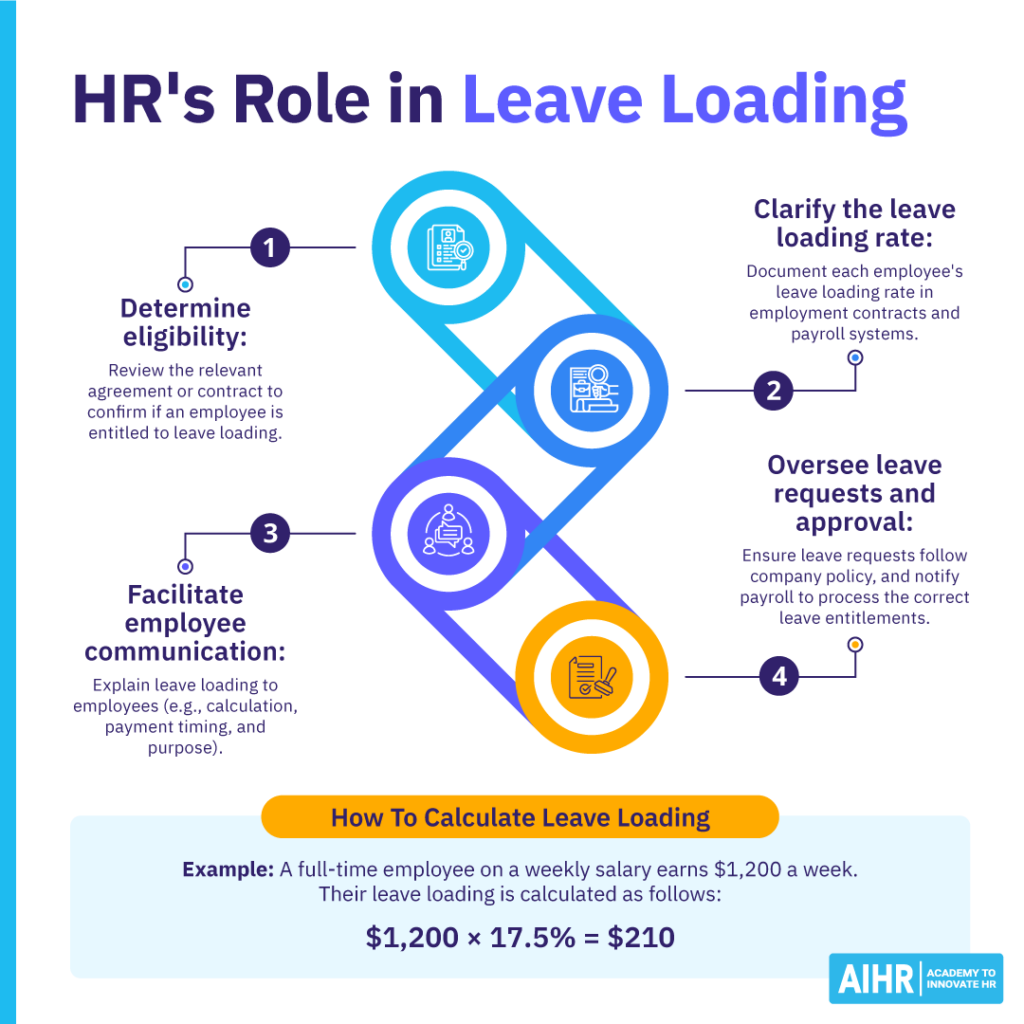

HR’s role in leave loading

HR must ensure agreements specify whether leave loading applies and at what rate, aligning with relevant awards or enterprise agreements. Misinterpreting entitlements can lead to disputes or legal non-compliance. Here’s a breakdown of HR’s role in leave loading:

- Determining eligibility: Check if the employee’s award, agreement, or contract includes leave loading.

- Clarifying rates: Confirm the correct rate (commonly 17.5% or a higher rate for shift workers) and document it.

- Communicating with employees: Explain how it works to ensure clarity and avoid any misunderstandings.

- Managing leave requests: Make sure leave requests follow company policy and inform payroll accordingly.

Payroll’s role in leave loading

Payroll plays a critical role in accurately calculating, processing, and reporting leave loading to ensure compliance and transparency. Payroll teams must manage these payments efficiently while aligning them with Fair Work requirements.

Payroll’s role includes:

- Automating calculations: Use payroll software to automatically and correctly calculate leave loading.

- Keeping accurate records: Track leave balances, pay rates, and loading amounts to ensure all relevant leave loading information is available.

- Ensuring tax and super compliance: Ensure extra pay is taxed correctly (PAYG withholding applies) and determine if superannuation is due.

- Auditing regularly: Check calculations to avoid errors and compliance risks.

How to calculate leave loading

Here are two examples to help you understand how to calculate and apply leave loading:

Example 1: A full-time employee on a weekly salary

- Weekly pay: $1,200

- Leave loading calculation: $1,200 × 17.5% = $210

- Total pay for one week of annual leave: $1,200 + $210 = $1,410

Example 2: A casual employee on an hourly rate

- Hourly base rate: $35/hour

- Weekly hours: 38

- Normal weekly earnings: $35 × 38 = $1,330

- Leave loading: $1,330 × 17.5% = $232.75

- Total pay for one week of annual leave: $1,330 + $232.75 = $1,562.75

HR tip

Use a leave loading calculator, or reliable payroll software that automatically applies leave loading when calculating fluctuating wages or multiple award rates. Remember though that you should always verify calculations against the FWO’s guidelines to ensure compliance.

How industry and agreement variations impact leave loading

17.5% is the most common rate, however, some industries and agreements specify different leave loading percentages:

- Higher rates: Some industries (e.g., emergency services, mining, healthcare) may use a rate above 17.5%.

- No leave loading: Some contracts or awards do not include it.

- Flat amounts: A fixed dollar amount might be used instead of a percentage.

- Corporate and office-based roles: Some agreements and contracts may not include leave loading, as these roles typically have fixed salaries without overtime.

- Government and public sector: Leave loading is often a standard benefit in government employment agreements.

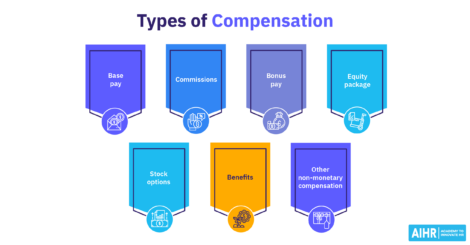

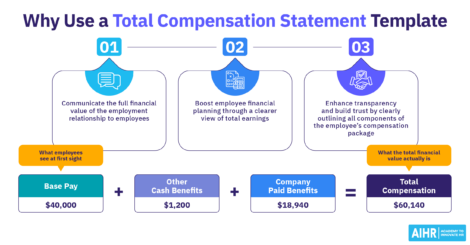

Learn how to design a compensation strategy

Develop a comprehensive rewards strategy that helps your business meet its objectives and provides a holistic Total Rewards strategy for its employees.

In AIHR’s Compensation and Benefits Certificate Program you’ll learn how to interpret data to identify pay gaps and draft an action plan towards pay equity. The online self-paced program will also teach you how to shape a holistic C&B strategy.

How to determine leave loading entitlements

Leave loading entitlements are typically determined through modern awards, enterprise agreements, and employment contracts.

Modern awards

Modern awards set minimum employment conditions. They often include leave loading calculated as a percentage of base pay (excluding overtime). If an award covers leave loading, it must be paid during annual leave and upon termination.

Not all workers are entitled to leave loading, as it depends on the specific award or agreement covering their employment. However, if an award includes leave loading, employers must provide it to eligible employees, typically alongside their regular pay during their annual leave. Additionally, employers must pay out accrued leave loading upon employment termination.

Enterprise agreements

Many enterprise agreements or EAs (i.e., negotiated desks between employers and employees) include leave loading. Some increase the rate beyond 17.5%, while others may replace it with different benefits.

EAs can modify or replace the terms in modern awards and can also include leave-loading provisions even if the relevant modern award does not. Additionally, an EA applies in place of any applicable modern award once the Fair Work Commission has approved it.

Employment contracts

If an award or agreement doesn’t cover an employee, their entitlement to leave loading depends on their employment contract. Employers must comply with the agreed terms if they offer it.

At the same time, salaried employees may have leave loading included in their salary packages. Both enterprise agreements and employment contracts must provide terms at least as favorable as those of the National Employment Standards (NES). Employers should review these agreements to ensure compliance with leave-loading obligations.

Legal fines in action

Woolworths Group was fined $1,227,000 after pleading guilty to having failed to pay over $960,000 in long service leave entitlements to 1,191 former employees between November 1, 2018, and January 29, 2023. The underpayments ranged from $250 to $12,000, which were due to a payroll error that occurred when the company mistakenly believed some managers were ‘award-free.’ This meant the managers were not paid their full entitlements, which included annual leave loading.

Annual leave loading vs. holiday leave loading

Annual leave loading is an additional payment (typically 17.5% of base pay) made when an employee takes paid annual leave, intended to compensate for lost overtime and penalty rates. Holiday leave loading, while sometimes used interchangeably, can refer more broadly to extra pay provided during specific holiday periods, which may be governed by different agreements or policies.

Let’s take a look at the difference:

Definition

Extra pay (usually 17.5% of base pay) on annual leave.

Extra pay for working on a public holiday.

Applicability

Paid during annual leave, as per the employee’s contract, award, or enterprise agreement.

Paid for working on a public holiday under specific contract conditions.

Calculation

Typically, 17.5% of an employee’s base weekly pay (though some awards specify a higher rate.

Usually calculated based on penalty rates, which may be 1.5x, 2x, or more of the base hourly rate for working on a public holiday.

Basis

Compensates employees for lost penalty rates, overtime, or shift allowances.

Compensates employees for the inconvenience of working on a public holiday.

Does leave loading apply on termination?

Leave loading applies to accrued but unused annual leave upon termination. Under FWO guidelines, employees entitled to it must receive their accrued annual leave and the applicable leave loading in their final payment when their employment ends.

Under the Fair Work Act 2009, if an employee’s modern award, enterprise agreement, or employment contract includes leave loading, any accrued but unused annual leave must be paid with the applicable leave loading when the employee exits the business. In some cases, the following exceptions may apply:

- Some enterprise agreements or contracts explicitly state that leave loading doesn’t apply to termination payments

- If the award or agreement is silent, case law and FWO rulings often support including leave loading in final payments

- Employers must check the applicable award, agreement, or contract to determine if leave loading is payable on termination.

The legal risks of not paying leave loading on termination

Not paying leave loading when required can lead to:

- Fair Work Ombudsman investigations

- Back payments with interest and fines

- Legal disputes and reputational damage.

How HR can ensure compliance

Use the following checklist to determine if your organization is compliant with the above FWO guidelines:

- Check if the employee’s contract stipulates leave loading in termination payouts.

- Determine the total unused annual leave balance upon termination.

- Use the standard 17.5% (or other specified) rate, if applicable.

- Ensure final payments reflect the correct accrued leave and leave loading.

- Provide a detailed payslip breakdown of accrued leave, leave loading (if applicable), and other entitlements.

- Conduct periodic reviews to catch errors and ensure ongoing compliance.

Superannuation on leave loading

According to the Australian Taxation Office (ATO), whether leave loading is payable on superannuation depends on its purpose. It’s payable if leave loading is part of an employee’s ordinary time earnings (OTE) and if the employment contract, award, or enterprise agreement doesn’t specify leave loading as compensation for lost overtime.

However, it’s not payable if the employee’s award, employment contract, or enterprise agreement states that leave loading is paid to compensate for missed overtime, as it’s not considered OTE.

Misconceptions about super on leave loading

Below are some common misconceptions about superannuation on leave loading, as well as the facts on these aspects of superannuation:

- Leave loading always attracts superannuation: In reality, super on leave loading depends on its purpose. It’s not required for lost overtime but is required if it’s a general entitlement.

- Payroll software automatically applies the correct super: Many payroll systems actually exclude superannuation from leave loading by default. Always verify payroll settings to ensure compliance and correct wages.

- If an award is silent on leave loading, super doesn’t apply: If no award or contract specifies a purpose for leave loading, the ATO considers it part of OTE, which means super is payable.

HR tip

Superannuation compliance can be tricky, especially in large organizations with complex payroll systems. Consult superannuation experts or the ATO to clarify award terms and avoid costly payroll errors, penalties, or audits.

To sum up

Leave loading is a critical extra payment that ensures employees are fairly compensated for lost overtime and penalty rates during their annual leave. HR teams must confirm eligibility, communicate entitlements clearly, and ensure contracts reflect the correct terms, while payroll must calculate and record these payments accurately.

Accurate leave loading management helps avoid legal penalties, costly back payments, and reputational harm. As such, HR and payroll should work together to maintain compliance with the Fair Work Act through regular audits and automated systems. This not only safeguards the business financially but also builds trust by ensuring employees receive their full entitlements.

FAQ

17.5% leave loading is an additional payment on top of an employee’s base wage when they take annual leave. It is designed to compensate for lost overtime and penalty rates the employee might have otherwise earned while working. While this is the standard rate, some agreements may specify a different percentage.

It’s only illegal if an employee is entitled to leave loading under their modern award, enterprise agreement, or employment contract, and the employer fails to provide it. In such cases, non-compliance can lead to legal penalties, back payments, and potential fines from the FWO. However, if leave loading is not specified in the agreement, employers are not required to pay it.

Yes. If an employee is entitled to leave loading under their award, enterprise agreement, or contract, they must receive it on any accrued but unused annual leave when they resign or are terminated. However, some agreements may explicitly exclude leave loading from termination payouts, so employers must check the specific terms of the applicable agreement.

Yes. Leave loading is considered taxable income and is subject to Pay As You Go (PAYG) withholding. However, whether it attracts superannuation depends on its purpose. If leave loading is explicitly for lost overtime, super may not apply. If it’s a general entitlement, superannuation is typically payable. Employers should verify their obligations based on ATO guidelines.

Learn more

Related articles

Are you ready for the future of HR?

Learn modern and relevant HR skills, online