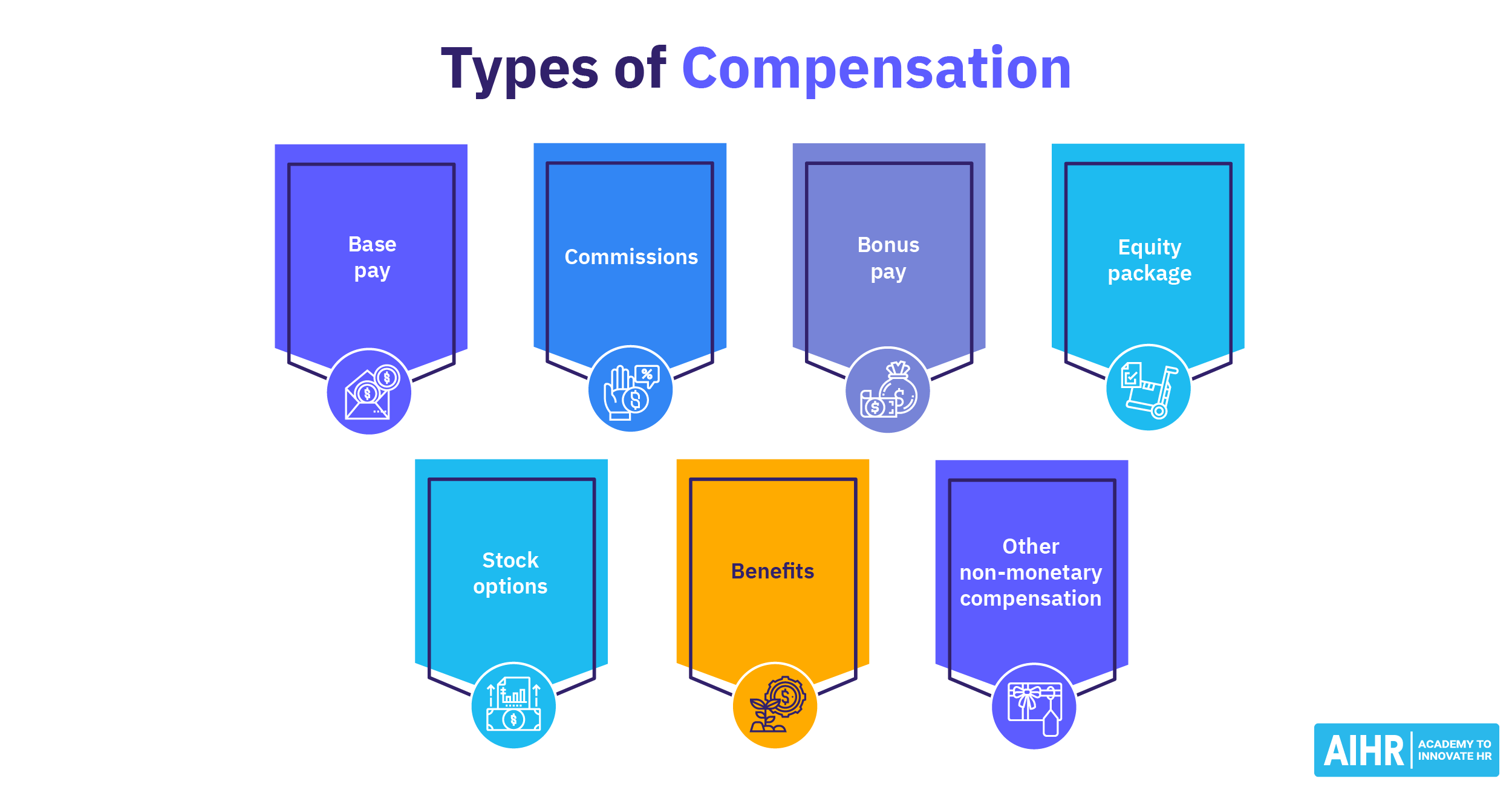

Discretionary Bonus

What is a discretionary bonus?

A discretionary bonus is a type of bonus an employer awards at their sole discretion, without any prior promise or expectation. Unlike non-discretionary bonuses, which are tied to specific performance metrics or contractual obligations, discretionary incentives are given based on an employer’s judgment, often as a reward for exceptional work, company performance, or other factors.

Some key features of discretionary bonuses include:

- No prior promise or expectation: The bonus cannot be promised in advance or expected by employees based on past practices. If employees can anticipate receiving it regularly, it may be considered non-discretionary instead.

- Solely at employer’s discretion: The employer has full control over the decision to grant the bonus, meaning it is not tied to specific performance metrics or contractual obligations.

- No predefined amount or timing: The bonus must not have a set amount or schedule. If an employer guarantees a certain bonus in advance, it no longer qualifies as discretionary.

- Not legally required or contractual: It cannot be mandated by law, included in an employment contract, or be part of a collective bargaining agreement.

- Exclusion from overtime calculations: If a bonus meets these criteria, it does not need to be factored into overtime pay calculations under the Fair Labor Standards Act (FLSA). However, if it is structured in a way that ties it to specific criteria, it may be reclassified as a non-discretionary bonus, which would be subject to wage calculations.

Discretionary vs. non-discretionary bonus

Differentiating between discretionary and non-discretionary bonuses is crucial for HR professionals to ensure compliance with legal regulations, particularly under the Fair Labor Standards Act (FLSA).

Description

A bonus given solely at the employer’s discretion, without prior commitment.

iA bonus that is promised or expected based on specific criteria (e.g. performance goals, sales targets, tenure, etc.)

Employee expectation

Employees do not expect it, as it is not guaranteed.

Employees may expect it if they meet the outlined requirements.

Legal consideration (FLSA — U.S.)

Not required to be included in overtime calculations if truly discretionary.

Must be included in the calculation of overtime pay under the FLSA.

Examples

Year-end bonuses given at management’s discretion, or spontaneous rewards for outstanding work.

Performance bonuses, retention bonuses, commissions, and productivity incentives.

Documentation

Typically not documented in contracts or policies.

Usually outlined in employment contracts, policies, or agreements.

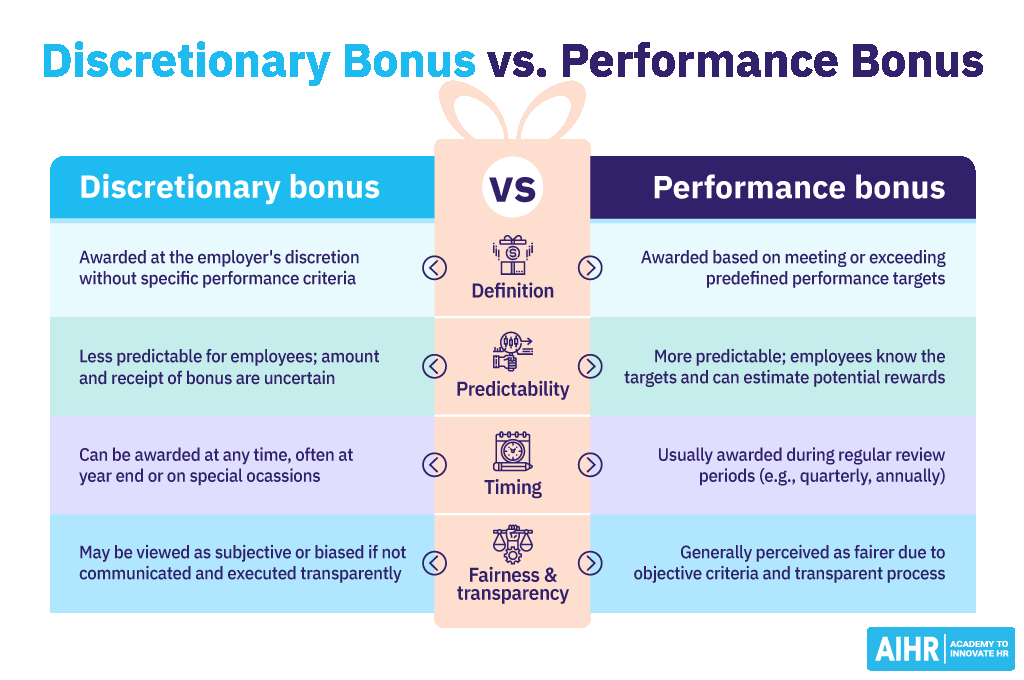

Discretionary bonus vs. performance bonus

While discretionary and performance bonuses reward employee efforts, they differ in nature and application. Discretionary bonuses are subject to the employer’s discretion and are not tied to specific performance metrics. On the other hand, performance bonuses are a form of non-discretionary bonus awarded based on meeting or exceeding specified performance criteria established in advance.

Discretionary bonus examples

Discretionary bonuses can vary widely depending on a company’s goals, the industry, and the roles of the employees receiving them. Here are some of the most common examples:

- Year-end or holiday bonus: A company decides to give employees a surprise bonus at the end of the year as a token of appreciation, without any prior commitment.

- Spot bonus: An employer rewards an employee on the spot for exceptional performance, such as going above and beyond on a project.

- Retention bonus (unexpected): A bonus given to an employee as an incentive to remain with the company during a critical period. This type of bonus is often used during times of significant organizational change, high turnover in the industry, or upon completion of a crucial project.

- Special recognition bonuses: Granted for unique or exemplary contributions that do not fall under regular performance metrics. For example, an employee who leads a successful initiative that boosts company culture or effectively mentors other employees might receive this bonus as a form of special acknowledgment.

These bonuses are not tied to predefined criteria and are awarded solely at the employer’s discretion.

Non-discretionary bonus examples

Here are some examples of non-discretionary bonuses:

- Performance bonus: Employees receive a bonus for meeting specific performance targets, such as sales quotas or productivity goals.

- Retention bonus (promised in advance): A company offers employees a set bonus if they remain with the company for a specified period, such as during a merger or restructuring.

- Signing bonus: A new hire is guaranteed a bonus upon accepting a job offer, typically outlined in their contract.

- Attendance bonus: Employees receive a bonus for maintaining perfect attendance over a set period.

- Incentive bonus: A structured bonus program rewards employees for reaching key business objectives, such as completing a project ahead of schedule.

Use discretionary bonuses to drive engagement and reward excellence

Discretionary bonuses allow employers to recognize outstanding contributions without creating long-term obligations. When structured correctly, they boost morale while maintaining flexibility.

In AIHR’s Compensation & Benefits Certificate Program, you’ll learn how to design fair and compliant bonus structures that align with company goals and employee motivation.

What HR should consider when developing a discretionary bonus policy

When developing a discretionary bonus policy, HR should focus on legal compliance, fairness, and alignment with company goals. Here are some key considerations:

1. Legal compliance

- Ensure the bonus meets the right criteria under the Fair Labor Standards Act (FLSA) to avoid misclassification

- Verify that the policy aligns with state and local labor laws, as some jurisdictions have specific requirements regarding bonus payments

- Clearly define the discretionary nature of the bonus in policy documents to prevent legal disputes.

2. Clear communication

- Specify that these kind of bonuses are not guaranteed and are awarded at the company’s sole discretion

- Communicate how and when the company may choose to award bonuses without creating any expectations among employees

- Avoid language that could imply a regular or promised bonus, which could reclassify it as non-discretionary.

3. Fairness and consistency

- While discretionary pay does not follow strict performance metrics, HR should ensure they are awarded fairly to prevent perceptions of favoritism

- Consider establishing general guidelines on what types of contributions may be recognized (e.g., exceptional teamwork, innovation, or company success)

- Maintain flexibility while ensuring different teams and departments have equal access to discretionary rewards.

4. Budgeting and financial planning

- Establish a budget for these bonuses to ensure financial sustainability

- Consider how often bonuses may be given and their potential financial impact on the organization.

5. Documentation and record-keeping

- Keep internal records of why bonuses are awarded to track consistency and help with future decision-making

- Ensure managers understand how to document the bonuses properly to support transparency and accountability.

6. Manager training

- Educate managers on the difference between discretionary and non-discretionary bonuses to prevent miscommunication with employees

- Provide guidance on how to recommend employees for the bonus without creating expectations.

A comprehensive discretionary bonus plan not only helps maintain consistency in how bonuses are awarded but also motivates employees by making the criteria and process as transparent as possible.

HR tip

Use discretionary bonuses strategically to reinforce a positive workplace culture. Recognizing outstanding contributions with unexpected rewards can boost morale and engagement without creating an entitlement mindset.

FAQ

A discretionary bonus is a payment given at an employer’s discretion, without prior promise or expectation. It is typically based on company performance, individual contributions, or other factors determined by the employer. Unlike non-discretionary bonuses, it is not required by contract or policy.

Yes, a discretionary bonus is taxable. It is considered supplemental income by the IRS and is subject to federal, state, and local taxes, as well as Social Security and Medicare (FICA) taxes. Employers may withhold taxes using either the percentage method (a flat 22% federal rate) or the aggregate method, which combines the bonus with regular wages for withholding calculations.